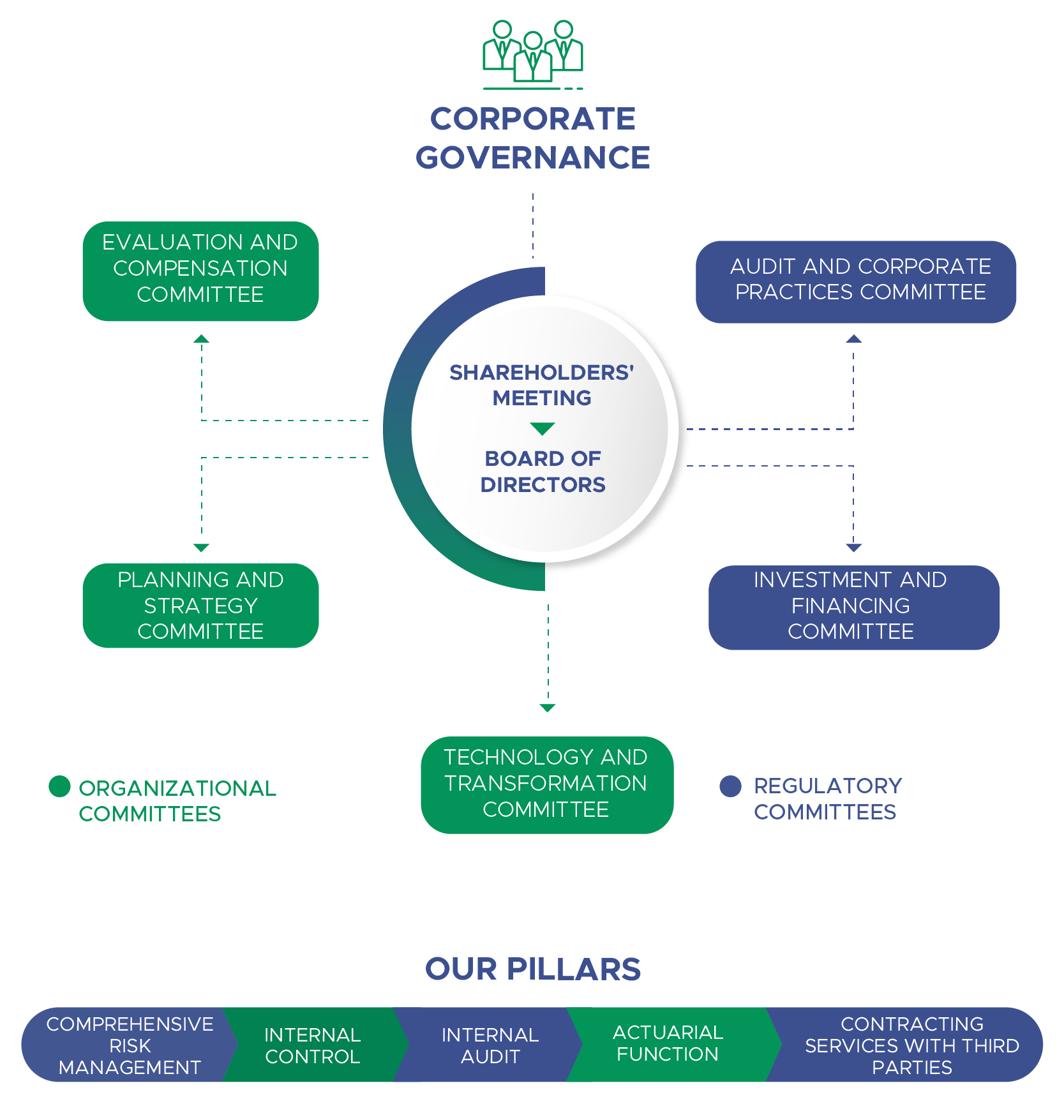

We have a corporate governance structure that ensures inclusive, participative, and representative decision-making through 5 organic committees (2 of which are regulatory) directly supporting the Board of Directors.

These governance bodies respond effectively to our needs as a Group as well as those of our stakeholders. Likewise, the structure allows the effective execution of the decisions made throughout our operation, generating direct benefits for our customers.

Evaluation and Compensation Committee

Purpose

To ensure that Grupo Peña Verde has the talent (especially at senior management level and in key positions) and organizational culture necessary to grow in a sustainable and competitive manner.

Integration

| Member | Position in Grupo Peña Verde | Role |

|---|---|---|

| Rogelio Velasco Romero | Independent Director | Committee Chairman |

| Janet Gallegos Junco | Human Capital Director | Committee Secretary |

| José Antonio Martí Cotarelo | Independent Director | Member |

| Anthony John Phillips | Independent Director | Member |

| Lilia Ivonne Hernández García | Independent Director | Member |

Planning and Strategy Committee

Purpose

To support the Executive Presidency in the achievement and development of the business strategy, as well as in the implementation of an adequate corporate governance and internal control.

Integration

| Member | Position in Grupo Peña Verde | Role |

|---|---|---|

| Manuel Santiago Escobedo Conover | CEO | Committee Chairman |

| Enrique Zorrilla Fullaondo | Presidente del Consejo | Member |

| Juan Manuel Gironella García | Director and Chairman of Reaseguradora Patria | Member |

| Pablo de la Peza Berríos | Director and Chairman of General de Seguros | Member |

| Alejandro Alfonso Díaz | Director and Chairman of General de Salud | Member |

| Astrid Jacobo Sánchez | Director de Estrategia y Sustentabilidad | Strategy and Sustainability Director |

Note: The Committee was established during 2021.

To introduce corporate governance and internal control best practices thorough our Group, the Planning and Strategy Committee complies with Article 69 of Mexico’s Insurance and Bonding Institutions Law (Ley de Instituciones de Seguros y de Fianzas, known as LISF for its Spanish acronym), which explicitly requires institutions to establish policies and procedures regarding:

Comprehensive Risk Management

Our Comprehensive Risk Management System encompasses all the policies, procedures, rules, frameworks, information systems and people in the Group that identify, evaluate, monitor, mitigate and control the risks arising from both external and internal sources and whose effects may have a significant impact on our operations, either individually and/or in aggregate.

Internal Control

The effective and permanent internal control system allows us to ensure that operations are carried out in accordance with the policies and/or procedures we have adopted at Grupo Peña Verde, in compliance with the applicable legal, regulatory, and administrative provisions, as well as the policies and standards approved by the Board of Directors, in order to foster a culture of prevention and minimize errors when carrying out our activities.

Actuarial Function

As part of the corporate governance system and in accordance with the provisions of current regulations, insurance institutions must follow actuarial rules and guidelines. In our Group, this function supports the Company’s technical management and is performed by people with sufficient expertise in actuarial, financial, and statistical mathematics, as well as with the necessary knowledge on the corresponding business line operations.

The actuarial function contributes to the effective operation of the integral risk management system, in particular to model the risk on which the calculation of the solvency capital requirement is based in terms of the provisions of the LISF, as well as in the periodic self-assessment of risks and solvency.

The General Insurance and Reinsurance Divisions have actuarial officers responsible for these tasks.

Third-Party Service Engagements

We have policies and procedures regarding third-party service engagements that comply with the obligations set forth in the law, standards, and applicable legal, regulatory, and administrative provisions.

These policies seek to prevent the hiring of third parties for any operational activities when such contracting could result in:

a) Deterioration of the quality or effectiveness of the corporate governance system

b) Excessive increase in operating risk

c) Undermining the Commission's ability to carry out its inspection and oversight duties

d) Impairment of the rendering of an adequate service to the user public

Technology and Transformation Committee

Purpose

To outline the development and integral digital transformation of our Group by driving the implementation of new technologies and market trends forward, seeking to generate value for customers and stakeholders.

Integration

| Member | Position in Grupo Peña Verde | Role |

|---|---|---|

| Manuel Santiago Escobedo Conover | CEO | Presidente |

| Astrid Jacobo Sánchez | Strategy and Sustainability Director | Secretario-no-Member |

| René González González | Executive Director of Business Support and Transformation Division (Head of IT) | Member |

| Moisés Cerezo Huitrón | Deputy Director of Technology Transformation | Member |

| Thomas James Cunningham | VP of Reinsurance Division | Member |

| Juan Ignacio Gil Antón | VP of Insurance Division | Member |

| Andrés Hernando Millán Drews | VP of the Asset Management and Financial Strategy Division | Member |

| Luiz Carlos Ferezin | Independent Director | Member |

| Guillermo Güémez Sarre | Independent Director | Member |

| Bárbara Mair Rowberry | Independent Director | Member |

| Guillermo Gómez del Campo | Independent Director | Member |

| Ney Galicia Arrocena | Deputy Director of Security | Guest member |

| Isaí Gómez Flores (Axity) | IT Service Provider | Guest member |

Note: The Committee was established in 2021.

Audit and Corporate Practices Committee

Purpose

To oversee our compliance with internal regulations, as devised by the Board of Directors, as well as with applicable legal and administrative provisions. It will also ensure that financial and operating information is prepared and reported with responsibility and transparency.

The establishment of this committee is mandatory based on article 72 of the LISF.

Integration

| Member | Position in Grupo Peña Verde | Role |

|---|---|---|

| Lorenzo Lazo Margain | Independent Director | Committee Chairman |

| Manuel Agustín Calderón de las Heras | Director of Corporate Governance and Regulations | Committee Secretary |

| Antonio Souza Saldívar | Independent Director | Member |

| Patricio Treviño Westendrap | Independent Director | Member |

The Audit and Corporate Practices Committee supports the Board by performing:

Internal Audit

Under a risk-based approach, the internal audit role in our Group is to design the annual audit program, which is authorized by the Audit Committee, ensuring that it is perfectly aligned with our strategic initiatives.

The Committee also reviews the internal control mechanisms implemented safeguard our resources, ensure compliance with applicable legal, regulatory, and administrative provisions and, therefore, protect the interests of our users. It also proposes improvements to our operations that contribute to achieving our objectives and goals.

Investment and Financing Committee

Purpose

Formulate our investment policy and strategy in accordance with the guidelines and thresholds proposed by the Risk Committee, which have been approved by our Board of Directors in compliance with current regulations.

The establishment of this Committee is mandatory under article 248 of the LISF.

Integration

| Member | Position in Grupo Peña Verde | Role |

|---|---|---|

| Manuel Santiago Escobedo Conover | CEO | Committee Chairman(1) |

| Saduj Emmanuel Muñoz Lara | Deputy Chief Investment Officer | Committee Secretary |

| Juan Ignacio Gil Antón | VP of Insurance Division | Member |

| Andrés Hernando Millán Drews | VP of Asset Management and Financial Strategy Division (Head of Investments) | Member |

| Fernando Francisco Miguel Álvarez del Río | CEO of General de Salud | Member |

| Francisco Fernando Martínez Cillero | CEO of Reaseguradora Patria | Member |

| Enrique Zorrilla Fullaondo | Independent Director | Member |

| Rogelio Ramírez de la O | Independent Director | Member |

| Álvaro Mancera Corcuera | Independent Director | Member |

| Darío Luna Plá | Director of General de Salud | Member |

| Verónica Alcántara Trejo | Independent Director of the Audit Committee at General de Salud | Member |

| Jorge Mercado Pérez | Independent Director of Reaseguradora Patria | Member |

| Carlos Cárdenas Guzmán | Independent Director of the Audit Committee at Reaseguradora Patria | Member |

| Julián Jorge Lazalde Psihas | Independent Director of General de Seguros | Member |

| Karl Frei Buechi | Independent Director of the Audit and Corporate Practices Committee at General de Seguros | Member |

| Pablo de la Peza Berríos | Independent Director of General de Seguros | Member |

| Manuel Agustín Calderón de las Heras | Director of Corporate Governance and Regulations | Guest member |

| Freddy Nolasco Ochoa | Corporate Risk Director | Guest member – Comprehensive Risk Management |

| DJosé Fernando Rodríguez Gual | Internal Audit Director | Guest member |

In addition to those previously mentioned, we have established different committees for specific operational purposes.

Tax Committee

Purpose

To analyze operational initiatives and adjustments arisen from changes to the tax legislation applicable to each of our subsidiaries. Likewise, it is responsible for the implementation of all tax changes throughout the Group.

Our Tax Committee is in charge of assessing tax risks, outlining, and approving the Company’s tax rules and strategies, and standardizing the tax criteria of the different subsidiaries. In order to comply with these criteria, the Committee is strongly supported by the corporate managers of each subsidiary.

The Tax Committee analyzes these identified situations and, in a collegiate manner, formulates a group-wide criterion, framing the guidelines for supervision and follow-up for each subsidiary.

The Tax Committee meets on a bimonthly basis and may also hold extraordinary meetings should there be an urgent matter for approval. At the bimonthly meetings, regulatory compliance is monitored and progress on the objectives set is evaluated.

It is worth mentioning that we do not currently have a defined company-wide tax strategy.

Integration

| Member | Position | Role |

|---|---|---|

| Norma Angélica Águila Pérez | Deputy Corporate Director of Administration and Finance | Committee Chairman |

| Christian Roberto López Yáñez | Corporate Tax Manager | Committee Secretary |

| Juan Adrián Martínez Armenta | Tax Manager (Insurance Division) | Member |

| Jorge Diego Pérez Ruiz | Tax Manager (Reinsurance Division) | Member |

| Gonzalo Galicia Díaz | Actuarial and Finance Director (Reinsurance) | Member |

| Fernando Flores Hernández Magro | Chief Financial Officer (Insurance) | Member |

| Manuel Agustín Calderón de las Heras | Director of Corporate Governance and Regulations | Guest member |

| Israel Trujillo Bravo | Corporate Legal Officer | Guest member |

| Moisés Senado | Tenured Expert Advisor | Guest member |

| Asesor Experto | Expert Advisor | Guest member |

Sustainability Committee

As of January 2021, we formally established the body responsible for the corporate sustainability strategy (aligned with ESG factors), as part of the Strategy and Sustainability Department, reporting directly to the Group's Chairman. Under this corporate sustainability strategy, we put together a Sustainability Committee that reports to our Planning and Strategy Committee.

Prior to this date, the area in charge (Social Responsibility) only managed operational activities related to the environmental, health and education and civic matters. The results of these activities were presented directly to the Company’s Chairman.