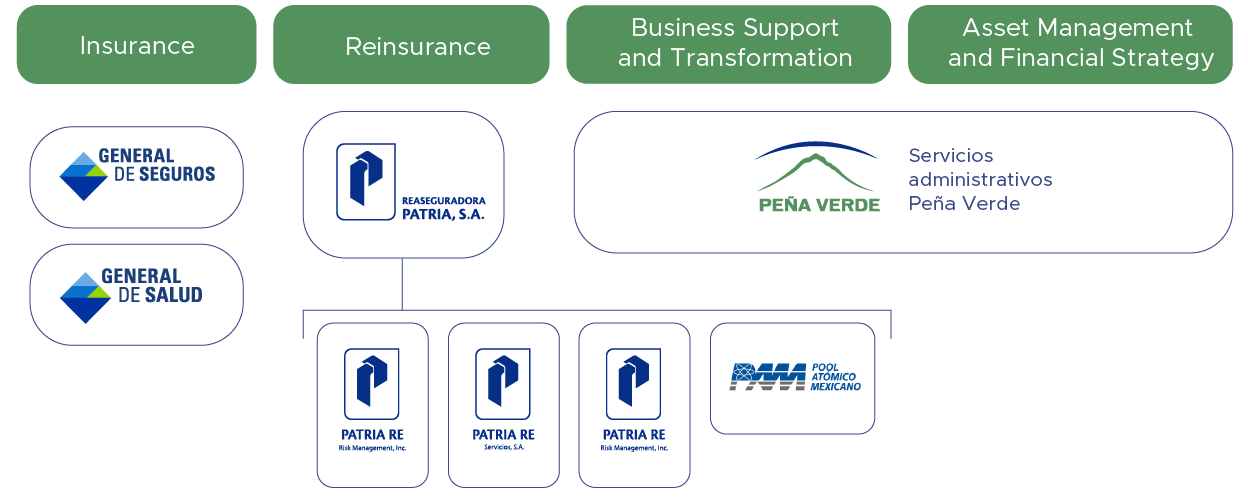

We have four business divisions, the Insurance and Reinsurance Divisions to conduct our risk management activities; the Business Support and Transformation Division (BST), which seeks to lead the Group to a prompt and cost efficient operation by virtue of technological and cultural transformation, and finally, the Asset Management and Financial Strategy Division (AMFS), whose main objective is to integrate efficient capital management in a common area.

The Insurance Division is formed by General de Seguros, which consolidates General de Salud and other subsidiaries, and the Reinsurance Division comprises Reaseguradora Patria, its Mexican and international operations, which are conducted through various subsidiaries.

Separately The BST and AMFS Divisions are part of Servicios Administrativos Peña Verde, a subsidiary incorporated with the purpose of building a participative and innovative organizational culture at Grupo Peña Verde, using a strategy that enhances organizational performance and combines experiences, in favor of strengthening our business areas towards high competitiveness and consolidate our position as a solid group capable of competing in the international market.

Therefore, we center our endeavors on two levers of value creation: on the one hand, we have our operations to generate resources that we can invest and an operating margin; and on the other hand, we have investment portfolios that support profit margins and diversify the risk we are incurring.

Insurance

General de Seguros

A Mexican company with a journey of more than 48 years in the Mexican insurance market, that has provided its clients alternatives for coverage of life, health and medical expense (through General de Salud), car and physical damages, as well as being one of the few companies that offer insurance for the agricultural sector (faithful to its commitment to Mexico and its countryside). It is also authorized to perform activities of credit insurance and reinsurance.

General de Seguros is known for its broad insurance portfolio suited to the protection needs of its clients at competitive rates, coupled with its guaranteed timely and efficient service.

Its proven track record propelled General de Seguros, S. A. B. to reach the #33 position in the Mexican insurance market at the end of 2020, considering the amount of direct written premiums.

Mission

To support our clients so that they can carry on with their lives and personal projects.

Vision

To be a well-known company, distinguished for our knack of listening, understanding and serving our customers and business partners.

Values

General de Salud

A Mexican insurance company, subsidiary of General de Seguros, which has achieved an outstanding track record and financial soundness with more than 15 years of experience and dedicated service vocation in the health industry.

Its products are designed to cover both personal needs and those of SMEs (group plans), ranging from a primary plan (prevention and medical consultation) to comprehensive coverage that includes ancillary services, maternity, dental, hospitalization, etc.

CCSS (Spanish acronym for Health Services Contact Center)

CCSS - Peña Verde, S. A. de C. V. is a company specialized in tele-health services, whose purpose is to ensure its users the appropriate level of medical care, to increase efficiency and reduce health costs.

CCSS serves more than 52,000 users in Mexico, from both public and private institutions:

Reinsurance

Reaseguradora Patria

Reaseguradora Patria is the oldest reinsurance company in Latin America. Since 1953, it has collaborated with the risk management of the reinsurance industry through comprehensive services and personalized advice on economic, technical and administrative topics. Its main business partners are insurance companies, surety companies and reinsurance brokers.

Patria’s geographical footprint extends to other countries, with operations in Chile, the United States and the United Kingdom, the latter through Patria Corporate Member, Ltd (PCM).

In this sense, it is worth noting that on November 13, 2020, we announced the closure of PCM's operations in the Lloyd's reinsurance market in the United Kingdom.

Mission

To participate in the business risk administration through comprehensive reinsurance services and personalized consultancy on economic, technical and administrative matters to build long-term business relationships for the benefit of our clients, stockholders, contributors, partners and the society in general.

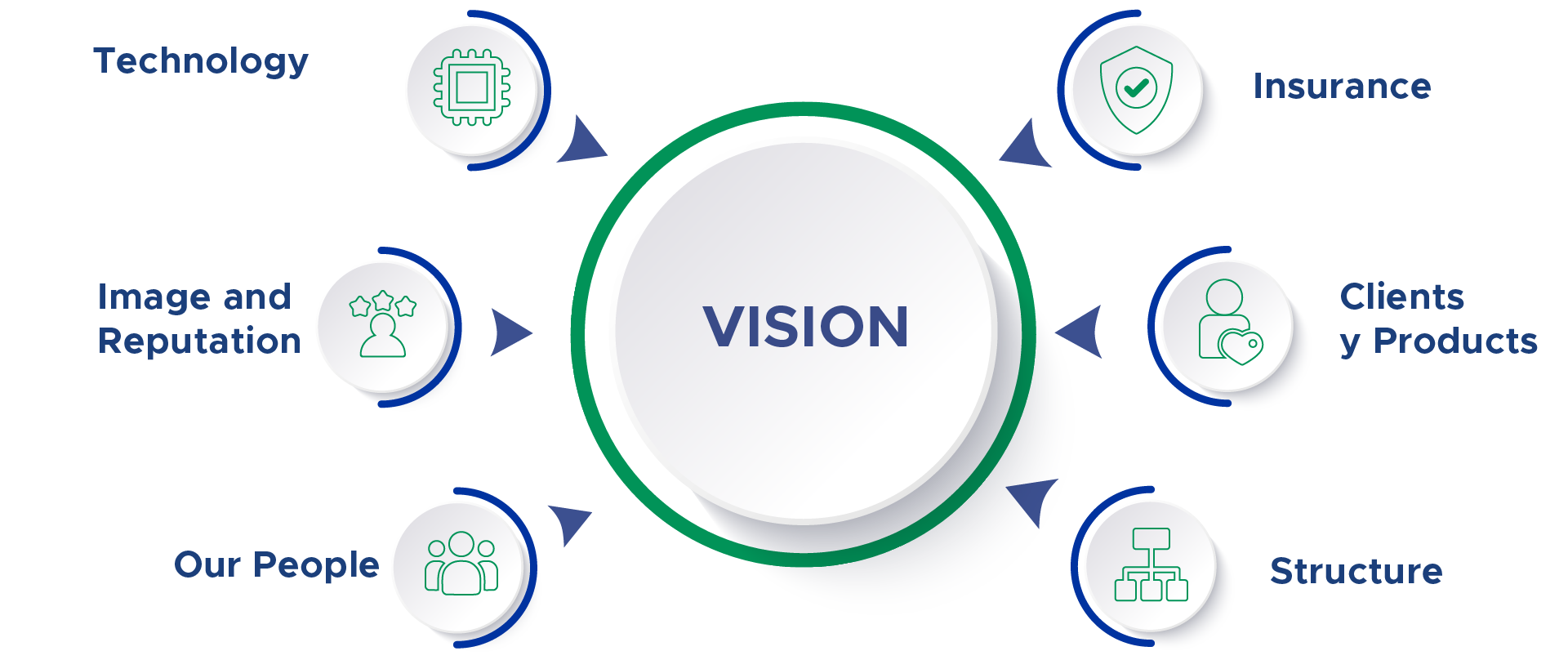

Vision

Reaseguradora Patria has a comprehensive vision that encompasses different components with specific objectives for each one:

Values

Business Support and Transformation Division (BST)

This newly-formed division seeks to coordinate efforts to achieve a technological and cultural transition in our Group, by way of two major strategic initiatives: our "Technology Plan" and "Cultural Transformation".

Technology Plan

- Lead us to an efficient operation in terms of time and cost

- While being flexible to support future business growth

- Integrating new solutions that are impossible as of today due to lack of capacity

- Stabilizing technological investment consistent with market standards in innovation projects

Cultural Transformation

- Moving from a hierarchy-based culture with a focus on people, to a culture that encourages flexibility, innovation, risk-taking, centered on individual and collective results, thus generating a measuring-oriented culture through:

- An assessment model aligned with the strategy

- Driving a culture of accountability

Asset Management and Financial Strategy Division (AMFS)

To integrate in our efficient management of capital a common area, given it is as a scarce asset, with the aim of attaining higher returns than those offered by the market by means of building and sustaining an optimal capital structure, we recently established the Asset Management and Financial Strategy Division.

Among the activities performed by this Division are: Investment Portfolio Management, Corporate Finance, Administration and Finance, and Procurement.

By managing these activities in a single area, we pursue a holistic vision by having a Division that has the whole picture of our finances. Some of the benefits of consolidating this area into the AMFS Vice Presidency are: i) cost reduction, ii) efficiency in financial and strategic communication, and iii) standardization of processes without losing the know-how and neglecting to the needs of each of our divisions.