Business Model

Our business model can be analyzed from two different perspectives which complement each other:

Holistic Perspective

It consists of analyzing Grupo Peña Verde as a single, vertically integrated company, dedicated to integral risk management with sustainability as its strategic backbone. We manage risks from their origination with the client (B2C - Multi-branch Insurance Division) to the transfer of risk (B2B - Reinsurance Division), with an efficient management of the investment and/or financing portfolio, and the support of an entity that promotes transformation, control, and business assistance.

Investment Portfolio

This vision treats Grupo Peña Verde as an investment portfolio that allocates its capital to the businesses with the best returns. We oversee the optimization of risk-return in risk management (Insurance or Reinsurance Division), compared to the return on investment or in complementary assets that complies with applicable corporate governance and seeks to generate economies of scale to maximize the returns on each investment. Under this view, the key task of the Insurance and Reinsurance Divisions is to capture the float.

2020-2025 Business Plan: Sustainable Profitability

In 2020, we drafted our 2020-2025 Business Plan, Sustainable Profit, which was presented and approved by the Boards of Peña Verde, S.A.B., and its subsidiaries, and is monitored through the strategic roadmap and Balanced Scorecard (BSC) indicators.

The Sustainable Profitability Plan envisages a strategy of company profitability and revenue doubling growth, making us as an attractive and prominent investment project for the Mexican and Latin American market that generates liquidity for shareholders.

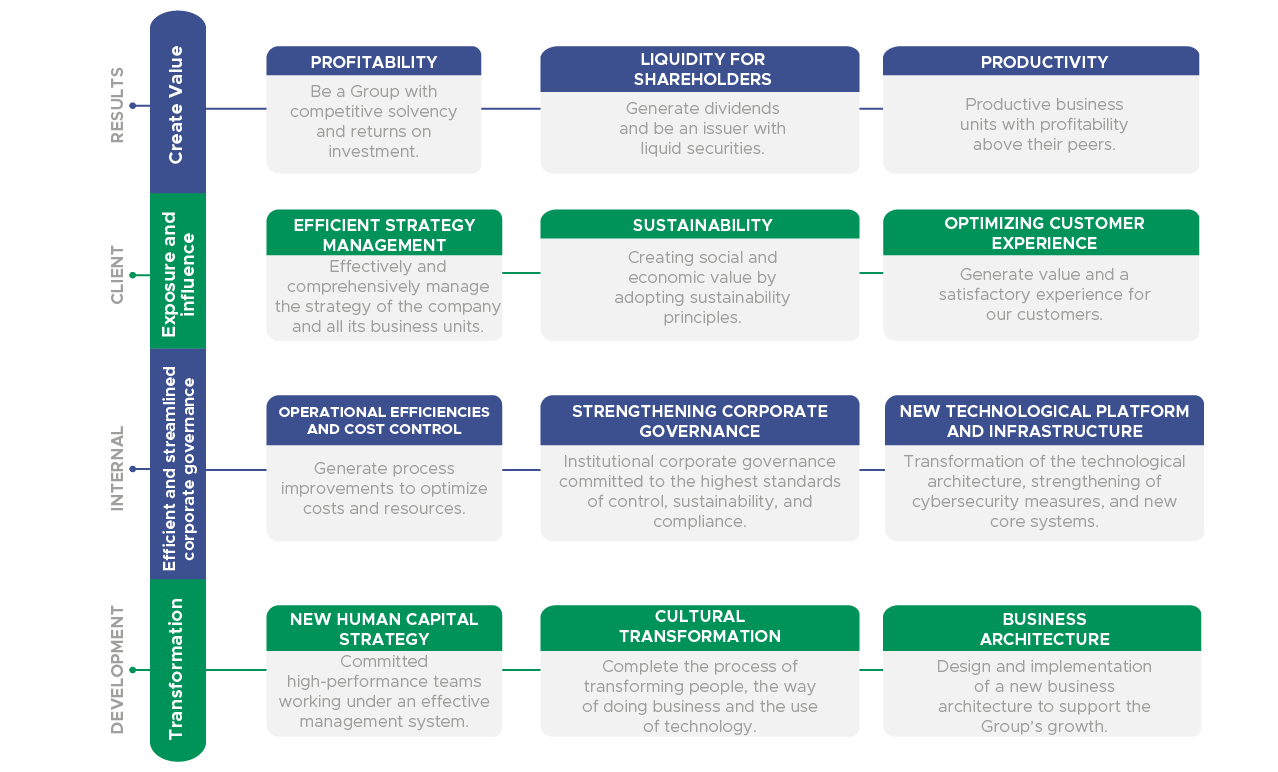

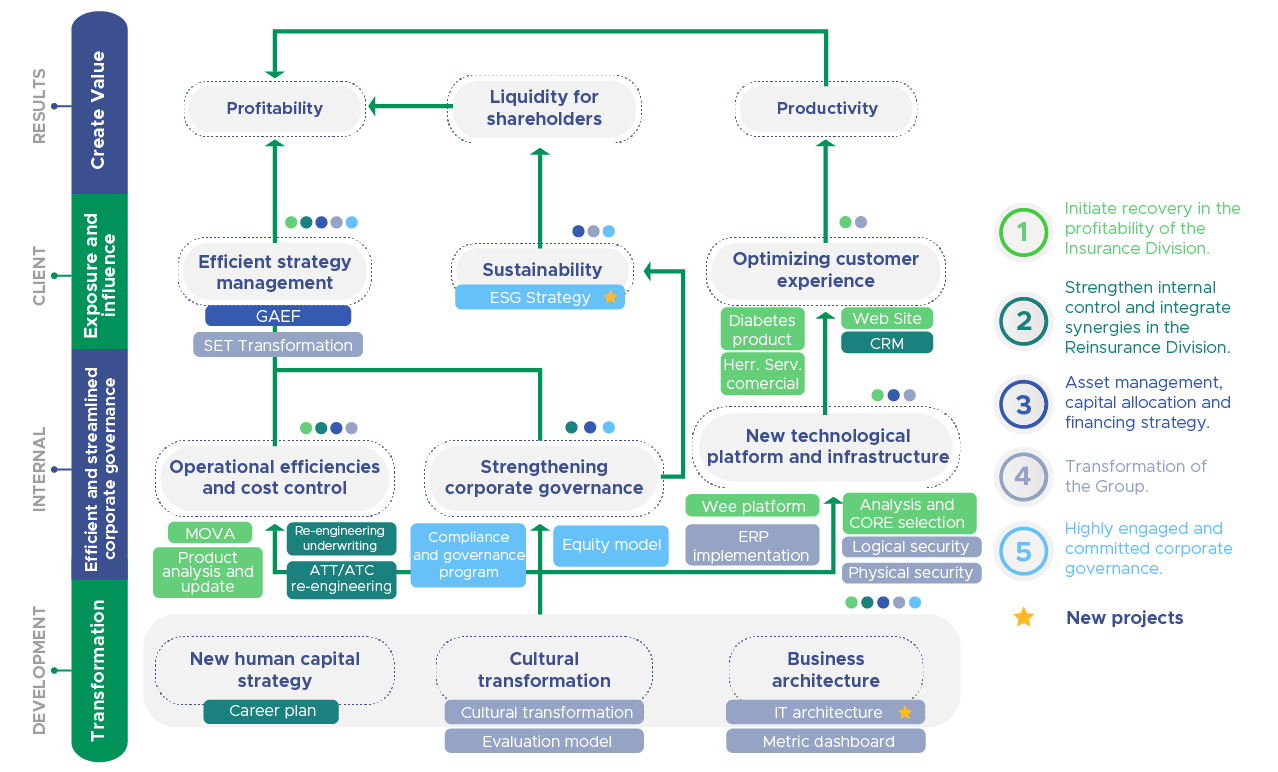

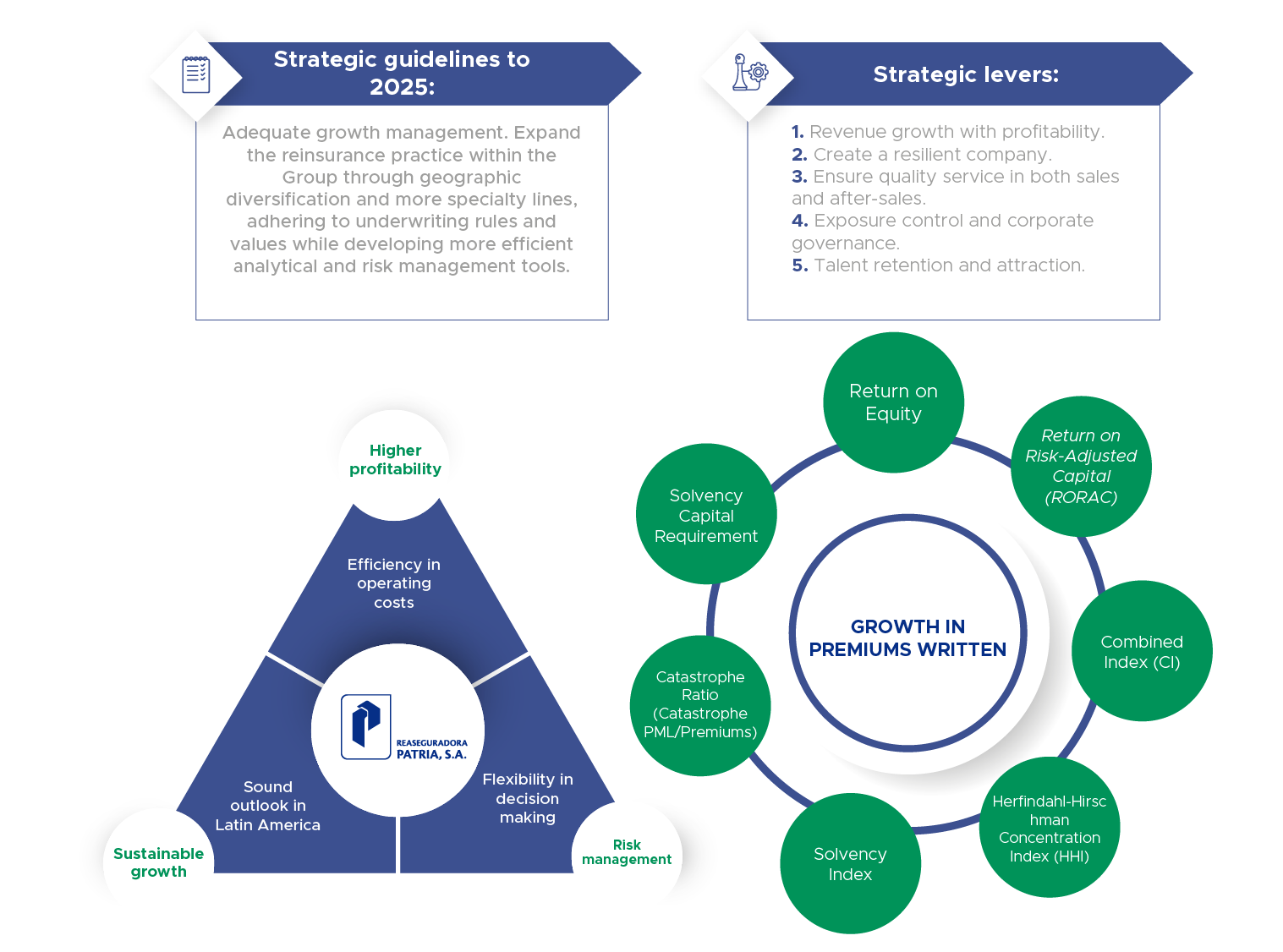

We formulated this plan on the following 5 strategic priorities:

1. Insurance Division: To be profitable in the Insurance Division

2. Reinsurance Division: Strengthen internal control and integrate synergies in the Reinsurance Division

3. AMFS Division: Consolidate a robust, efficient, and functional financing and capital allocation structure; and implement a successful asset management strategy

4. BST Division: Continue our technological and cultural transformation

5. Grupo Peña Verde: Maintain a highly engaged and committed corporate governance

In order to achieve these priorities, we defined the following strategic objectives:

We will seek to achieve these objectives by adhering the following strategic roadmap and supported by the initiatives mentioned above:

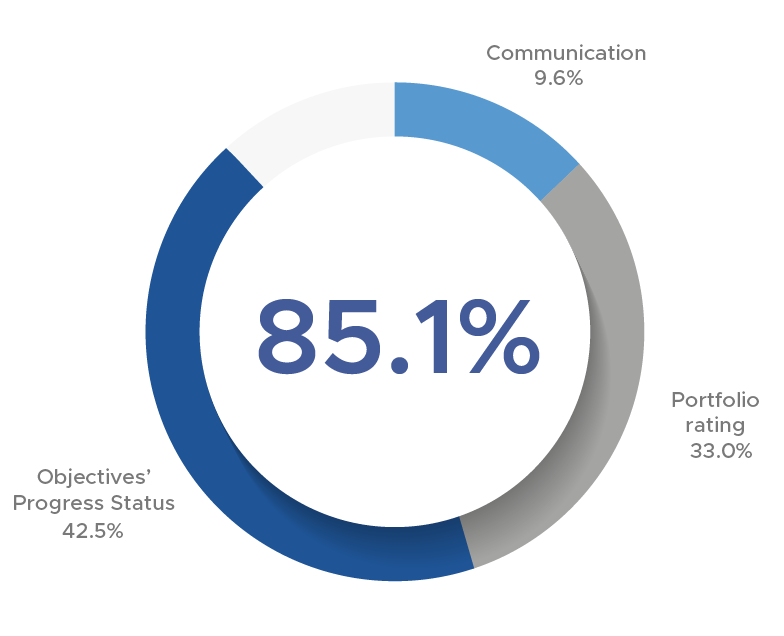

Annual Evaluation of Strategy Execution

In order to determine the impact on the management of our strategy at the executive level, we designed the Strategy Achievement indicator, which quantitatively measures the three main elements that make up its tracking:

- Strategy Communication: Through the percentage of employees who were trained during the corporate culture workshops at the strategic, tactical, and operational levels, with specific weightings for each one.

- Rating of the portfolio of initiatives: The projects executed by the Group are rated using a project diagnostic form with a scale from 0 to 5. The annual rating is the average of all initiatives.

- Achievement of strategic objectives: We evaluate the progress achieved in our specific objectives, assigning grades from 1 to 3 depending on the degree of completion. The final grade is calculated by dividing the points achieved over the maximum number of points possible.

We calculate this metric through a weighted average composed of the scores achieved in the previously mentioned points, and we evaluate it with a scale from 0 to 100%, where "0%" represents the minimum level of achievement of the objective, and "100%" represents the maximum value of completion.

2020 Evaluation Results

85.1%

Strategy |

10% | 96.4% |

|---|---|---|

| Strategic Level Tactical Level Operational Level |

50% 30% 20% |

97% 99% 91% |

Rating of the Portfolio |

40% | 82.4% |

| Rating of the Company’s Portfolio | 100 | 4.12 |

Achievement of |

50% | 84.95% |

| Overall result of the Company’s achievement of objectives, obtained from the Group’s BSC | 100% | 0.85 |

In addition, we established a number of specific objectives to quantify the progress achieved in the Insurance and Reinsurance Divisions.

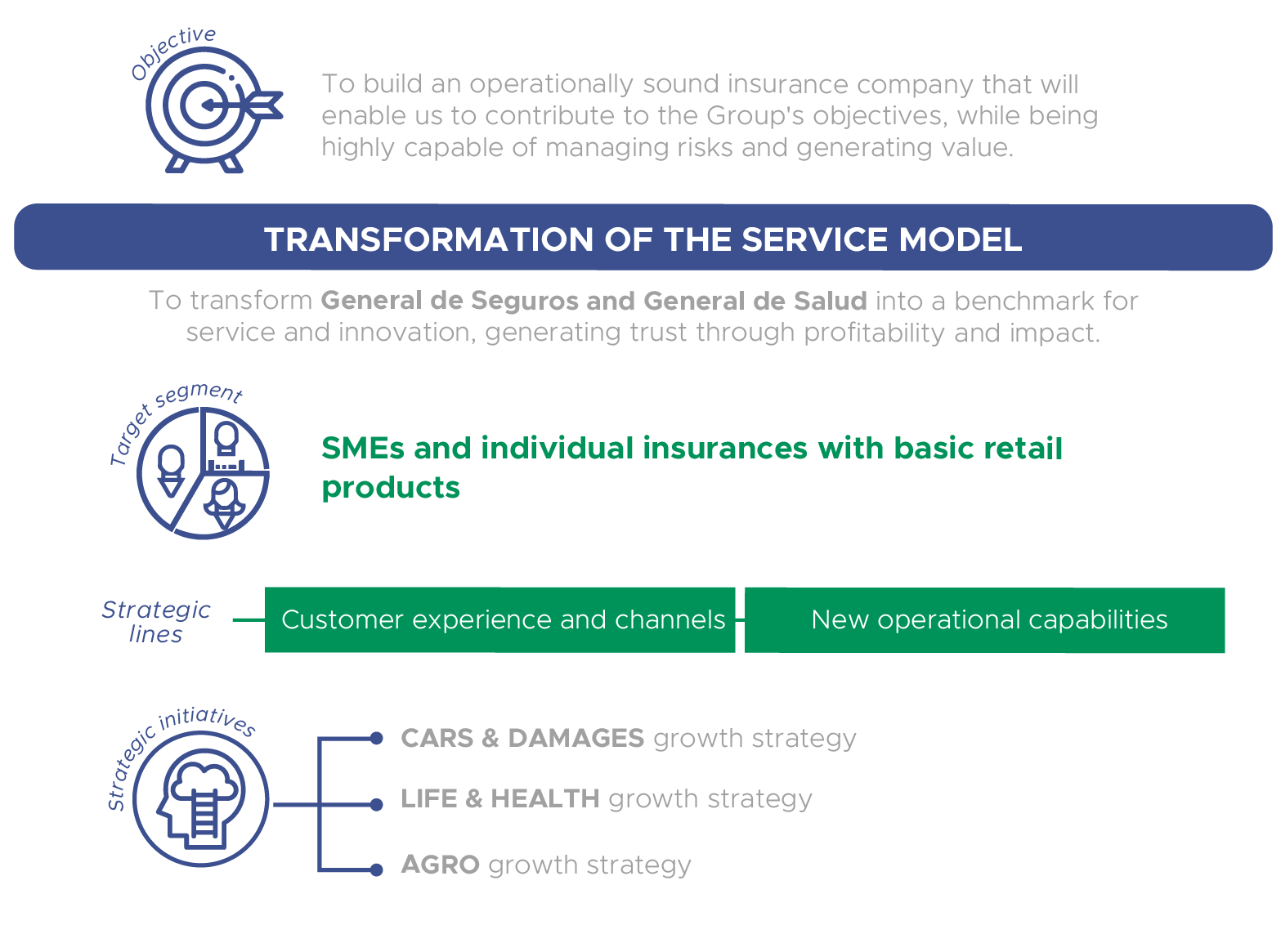

What do we expect from this Division?

- Written Premiums: To increase from Ps.2,500 million in 2019 to >Ps.5,000 million in 2025.

- Combined Ration: Reach levels of around 90%.

- FY Net Income: Achieve a net income greater than Ps.400 million by 2025.

What do we expect from this Division?

- Written Premiums: To increase from Ps.5,700 million in 2019 to >Ps.11,000 million in 2025.

- Combined Ration: To be below the 90% threshold.

- FY Net Income: Achieve a net income greater than Ps.400 million by 2025.